Bitget: A Derivatives Exchange with the Ambition to Surpass Binance

Founded in 2018, Bitget has rapidly emerged as a significant player in the global cryptocurrency exchange landscape, specialising in derivatives trading. Positioned as a challenger to the industry’s giants, Bitget has taken bold steps to innovate its service offering, expand its reach, and refine user experience. As of June 2025, it remains one of the top exchanges by open interest and daily trading volume in futures contracts, driven by its aggressive growth strategy and international ambitions.

Bitget’s Strategic Position in the Derivatives Market

Bitget holds a prominent place among derivatives-focused crypto exchanges, often ranking just behind Binance and OKX in futures trading volume. Unlike many competitors, Bitget chose to prioritise derivatives over spot trading in its formative years. This strategic focus allowed the exchange to gain traction among professional traders seeking robust tools, high leverage options, and deep liquidity for perpetual contracts.

In the first half of 2025, Bitget reported over $8 billion in average daily trading volume for perpetual contracts, placing it in the top five globally. It supports more than 200 USDT-margined futures pairs and offers up to 125x leverage on selected contracts. These features, combined with competitive trading fees and intuitive UI, contribute to its growing market share.

Bitget also differentiates itself by placing strong emphasis on compliance and risk management. The exchange has acquired regulatory registrations or licences in several key markets, including Lithuania, Australia, and the UAE, and continues to invest in its legal and security frameworks.

Key Innovations and Growth Drivers

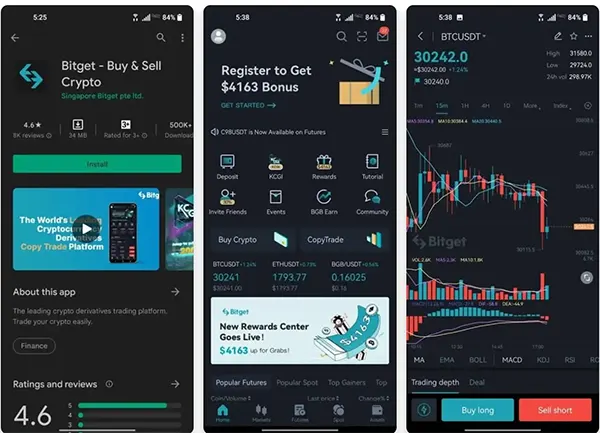

One of Bitget’s most talked-about innovations is its flagship “Copy Trading” feature, which enables less experienced users to automatically follow the strategies of top traders. This has attracted a large retail user base and contributed to the exchange’s growth, particularly in regions like Southeast Asia and Latin America.

Additionally, Bitget’s partnership with sporting celebrities and teams — most notably football icon Lionel Messi — has given the brand a high-visibility global presence. These marketing moves have elevated the exchange’s recognition beyond the typical crypto audience and helped it attract a broader demographic.

Another critical growth driver is Bitget’s launchpad and innovation zone, where new tokens are introduced before listing on major exchanges. This allows early adopters and institutional investors to gain early access to emerging projects and strengthens Bitget’s reputation as a forward-thinking exchange.

Security, Transparency and Proof of Reserves

Following the collapse of FTX, crypto exchanges faced heightened scrutiny regarding asset transparency and user fund protection. Bitget responded by implementing a Merkle Tree-based Proof of Reserves system. As of June 2025, the exchange maintains a reserve ratio exceeding 200%, which means it holds more than double the user assets in segregated cold wallets.

The exchange regularly publishes third-party audit reports that detail wallet holdings, liabilities, and reserve ratios. These reports are publicly accessible and updated monthly. Bitget also introduced a $300 million Protection Fund, designed to compensate users in case of unforeseen platform security incidents or systemic failures.

From a technical standpoint, Bitget uses multi-signature cold wallets, continuous penetration testing, and industry-standard encryption protocols to safeguard digital assets. In doing so, it has avoided major hacks or data breaches since its inception, which is a strong indicator of its operational maturity.

User Protection and Regulatory Compliance

Bitget’s compliance strategy includes proactive engagement with regulators. In 2025, the exchange received formal approval to operate in Lithuania under its VASP framework and is undergoing registration in key jurisdictions including Hong Kong and the UK. It has also enhanced its KYC processes, introducing facial recognition and blockchain analysis tools to prevent illicit activity.

To ensure user fund protection, Bitget does not engage in rehypothecation or lending of user deposits. This approach offers a higher degree of security compared to some competitors. Furthermore, its withdrawal processing time averages under 20 minutes, reflecting strong backend infrastructure and operational readiness.

Bitget also offers educational materials, multilingual support, and 24/7 customer service, further reinforcing its reliability and commitment to user welfare. These factors collectively enhance trust among institutional and retail clients alike.

Comparing Bitget to Binance: Differentiators and Challenges

While Binance remains the industry leader by trading volume and user base, Bitget is carving a niche through its targeted focus on futures, innovative social trading tools, and regulatory alignment. Bitget’s leaner structure allows for faster implementation of product changes, while Binance often faces delays due to its size and regulatory friction in certain regions.

Bitget’s “better than Binance” ambition stems from its belief in specialised service. By offering an exchange tailored for traders rather than generalists, it aims to become the go-to destination for derivatives trading. Additionally, the brand’s consistent proof-of-reserves publishing gives it an edge in transparency amid growing calls for accountability in crypto.

However, Bitget still faces key challenges — particularly in achieving deeper market penetration in North America and expanding its fiat onramp offerings. As of mid-2025, it supports fewer fiat currencies and payment methods than Binance, which could hinder onboarding for some users in regulated jurisdictions.

Future Outlook and Strategic Goals

Bitget plans to expand its footprint in Europe and the Middle East throughout 2025, aiming to acquire more regulatory licences and broaden its fiat gateways. The firm is also investing in layer-2 integration to reduce trading fees and enhance transaction speeds. These technical improvements are designed to support institutional clients and algorithmic traders.

Moreover, Bitget has announced its intent to enter the tokenisation space, exploring the issuance of RWAs (real-world assets) and asset-backed tokens. This aligns with growing industry trends and regulatory developments around asset tokenisation and could become a new growth area.

In sum, while Bitget may not yet rival Binance in every metric, its bold vision, user-first philosophy, and strategic investments suggest it is well positioned to remain a top-tier crypto exchange. Its continued focus on transparency and innovation will be pivotal in determining how close it comes to realising its ambition.