KCEX Review 2026: Zero-Fee Trading and Emerging Market Models

KCEX is a centralised cryptocurrency exchange that has steadily gained attention due to its zero-fee spot trading model and an unusually wide range of listed trading pairs. While it remains less visible than major global exchanges, its structure raises relevant questions about sustainability, liquidity quality, and the real cost of commission-free trading. This review focuses on how KCEX operates in 2026, what users actually gain from its model, and where practical risks still remain.

Zero-Fee Trading Model and Its Economic Logic

KCEX applies a zero-fee structure to spot trading, meaning neither maker nor taker commissions are charged on standard spot transactions. In practical terms, this removes one of the most predictable costs for active traders, especially those operating with high turnover or narrow margin strategies. For retail users, this model reduces friction when entering or exiting positions.

However, zero trading fees do not imply the absence of revenue mechanisms. KCEX relies on alternative income streams such as futures trading fees, funding rates, listing arrangements, and internal liquidity incentives. These elements collectively compensate for the lack of spot commissions and form the economic backbone of the exchange.

From a sustainability perspective, this structure shifts costs away from basic spot traders toward more advanced or leveraged participants. This approach is not unique in 2026, but KCEX applies it more aggressively than most competitors, making the model attractive while also more dependent on consistent derivatives activity.

Hidden Costs and Structural Trade-Offs

Although spot trades carry no direct commission, users still encounter indirect costs. Bid–ask spreads on lower-volume pairs can be wider than expected, particularly during periods of reduced market activity. These spreads effectively replace traditional fees in certain market conditions.

Withdrawal fees are asset-specific and adjusted dynamically based on network conditions. While generally aligned with industry norms, they represent a cost point that zero-fee messaging does not always emphasise. For frequent movers of on-chain assets, this factor becomes relevant.

Another trade-off lies in execution quality. On highly liquid pairs, order filling is usually consistent, but on newly listed or niche assets, slippage can offset the benefit of commission-free execution. Zero fees do not guarantee optimal trade outcomes across all markets.

Liquidity Depth and Trading Pair Diversity

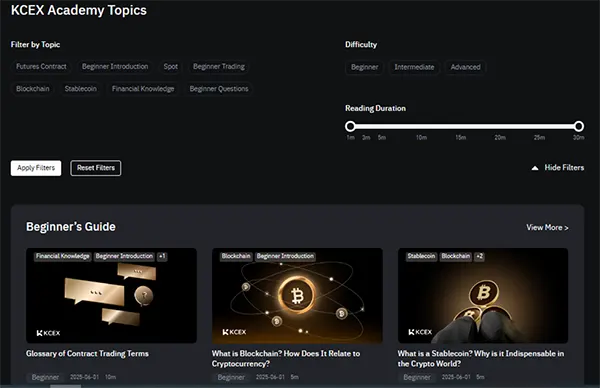

One of KCEX’s most visible characteristics is the sheer number of available trading pairs. By 2026, the exchange lists several hundred assets across spot and futures markets, including a significant share of emerging and mid-cap tokens. This breadth attracts users seeking early access to less established projects.

Liquidity, however, is unevenly distributed. Major pairs such as BTC/USDT and ETH/USDT demonstrate stable order books and acceptable depth for retail and semi-professional traders. Outside of these core markets, liquidity conditions vary significantly.

This uneven structure suggests that KCEX prioritises market coverage over uniform depth. While this strategy supports asset discovery, it requires traders to assess liquidity pair by pair rather than relying on a consistently deep market environment.

Assessing Real Liquidity Versus Nominal Volume

Reported trading volume alone does not fully reflect executable liquidity. In practice, the ability to place medium-sized orders without material price impact is a more relevant metric. On KCEX, this threshold differs substantially between top-tier and secondary pairs.

Some pairs exhibit active order books but limited depth beyond the first price levels. This can lead to partial fills or unexpected average execution prices during volatile periods. Traders using market orders are particularly exposed to this effect.

For disciplined users applying limit orders and focusing on established pairs, liquidity conditions are generally adequate. For speculative trading on illiquid assets, caution is required, regardless of the nominal volume figures displayed.

User Incentives, Risks, and Comparison with Traditional Exchanges

KCEX positions itself as a low-barrier exchange, appealing to users who value cost efficiency over advanced institutional tooling. Zero-fee spot trading lowers entry friction and encourages experimentation with smaller position sizes.

In contrast to traditional exchanges that rely heavily on tiered commission structures, KCEX places greater emphasis on derivatives participation and promotional liquidity programmes. This shifts user incentives toward higher-risk instruments.

From a regulatory and operational standpoint, KCEX operates under a lighter framework than some long-established competitors. While this allows flexibility and faster listings, it also places greater responsibility on users to manage counterparty and custody risk.

Risk Profile and Practical Suitability in 2026

The primary risk associated with commission-free trading lies in behavioural patterns. Traders may increase activity due to the absence of fees, potentially amplifying losses through overtrading rather than improving performance.

Operational risk remains comparable to other mid-tier centralised exchanges. Asset custody, withdrawal processing, and system stability are generally reliable, but KCEX does not yet match the transparency standards of the most regulated global players.

For cost-sensitive traders with a clear strategy and realistic expectations, KCEX represents a functional trading environment. It is best approached as a specialised exchange rather than a universal replacement for long-established market leaders.